As the 2026 tax season unfolds, understanding how IRS tax refunds are processed is essential for taxpayers eager to receive their money on time. While refund rules remain largely consistent with previous years, filing methods, credits claimed, and return accuracy continue to play a major role in determining how quickly refunds are issued.

This guide explains IRS refund timelines for 2026, key rules taxpayers should know, and what to realistically expect during the refund process.

How IRS Refund Processing Works in 2026

The Internal Revenue Service processes refunds after a tax return is officially accepted. For electronically filed returns, acceptance typically happens within 24 to 48 hours. Once accepted, the IRS begins reviewing the return for accuracy, income verification, and eligibility for credits.

Paper-filed returns take significantly longer, often requiring weeks before processing even begins.

Standard IRS Refund Timeline

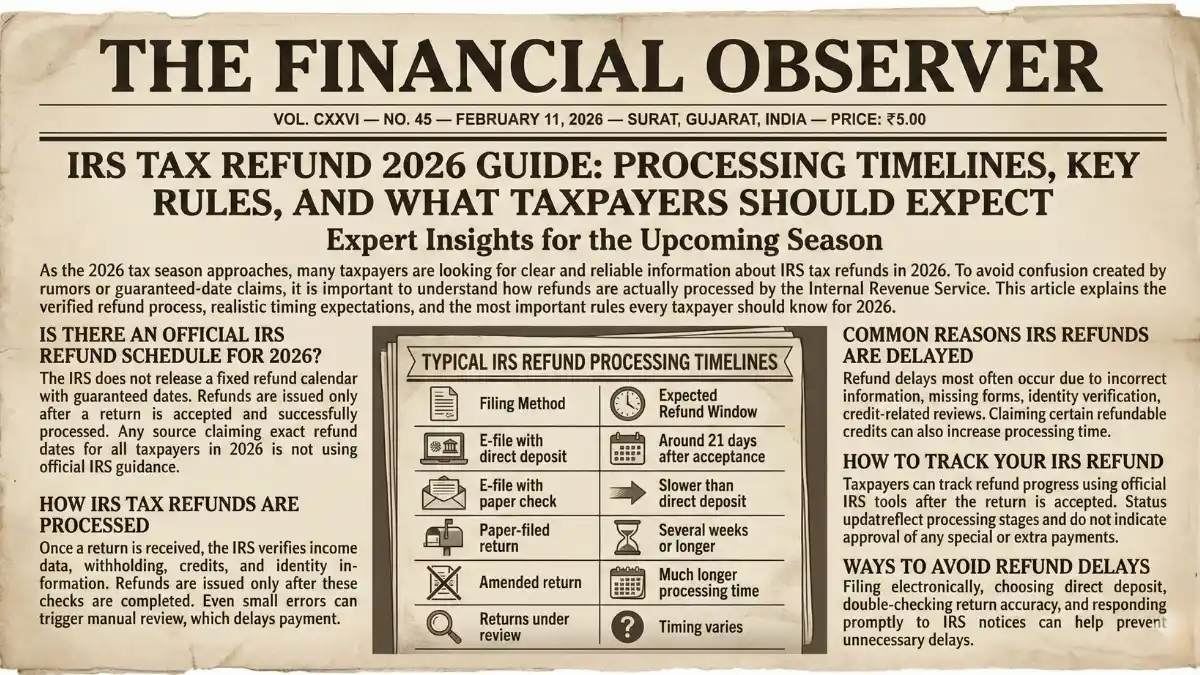

For most taxpayers who file electronically and choose direct deposit, refunds are usually issued within 21 days of return acceptance. This remains the IRS’s standard benchmark for 2026.

However, the 21-day timeline is not guaranteed. It applies only to straightforward returns that do not require additional review or verification.

Key Rules That Can Affect Refund Speed

Several IRS rules can slow down refunds even if a return is filed correctly. Returns that include refundable credits such as the Earned Income Tax Credit or the Additional Child Tax Credit are subject to extra review under federal law.

Identity verification checks, mismatched income information, missing forms, or math errors can also delay refunds. In such cases, the IRS may require manual processing, which can extend timelines into late February or March.

Direct Deposit vs Paper Checks

Direct deposit remains the fastest and safest way to receive a refund in 2026. Once approved, refunds sent by direct deposit often reach bank accounts within a few business days.

Paper checks take longer due to printing and mailing times. Taxpayers who still choose paper filing or mailed refunds should expect longer wait periods.

How to Track Your IRS Refund

Taxpayers can track their refund status using the IRS refund tracking system, which updates daily. Refunds typically move through three stages: return received, refund approved, and refund sent.

Once marked as sent, direct deposit refunds usually appear in bank accounts shortly after, depending on bank processing schedules.

Common Reasons IRS Refunds Are Delayed

Delays often occur due to incorrect personal details, invalid bank information, or discrepancies between reported income and IRS records. Filing late in the season or submitting incomplete returns can also slow processing.

Responding promptly to any IRS notices helps prevent further delays and keeps refunds moving forward.

What Taxpayers Should Expect in 2026

Most taxpayers who file early, file electronically, and avoid errors can expect refunds within the standard 21-day window. Those claiming certain credits or requiring additional verification should prepare for longer timelines.

Staying informed, filing accurately, and using direct deposit remain the best ways to ensure a smooth refund experience during the 2026 tax season.

Final Takeaway

IRS tax refund processing in 2026 continues to prioritize accuracy and security. While refunds are moving efficiently for many taxpayers, timelines can vary based on filing choices and return complexity. Understanding the rules and tracking tools helps taxpayers set realistic expectations and avoid unnecessary stress during tax season.